If you are a regular reader of this blog, you are aware of my extremely pessimistic forecast for the American dollar over the next few years. If you are still not convinced the coming collapse of the dollar is inevitable, or if you have at any time in the last four or five months looked at your brokerage account statement and thought to yourself, "Thank God for my Google (or Apple) stock, because everything else I own is going down," then please read this, this, and this before it is too late.

If you are a regular reader of this blog, you are aware of my extremely pessimistic forecast for the American dollar over the next few years. If you are still not convinced the coming collapse of the dollar is inevitable, or if you have at any time in the last four or five months looked at your brokerage account statement and thought to yourself, "Thank God for my Google (or Apple) stock, because everything else I own is going down," then please read this, this, and this before it is too late. As a regular reader, you are also now well armed to take action to not only preserve your capital during the ongoing destruction of the standard of living of the average American family, but to also prosper as others suffer. I want to state quite clearly that I am not happy about these ongoing events of historical significance that are being ignored by the mass media in favor of the latest developments in the lives of Paris Hilton, Lindsey Lohan, Brittany Spears, OJ Simpson (again!?), and Natalee Holloway (oh wait, she's still dead), and I sincerely wish that I could instead post regularly about ways to make money by investing in America. It greatly saddens me that I cannot do so. Unfortunately, we are way past the point of no return of America's decline as a great power, and it is critical to focus on taking action now to protect you and your family from being sucked under by the coming economic hard times.

By the time Americans go to the polls next November, we will be in the midst of a protracted recession, or possibly the first actual depression since the 1930's. In economic hard times throughout American history, voters have without exception, "tossed the bums out," and handed power over to the out of power political party. This means only one thing - President Hillary Rodham Clinton. Senator Clinton's main problem is that she has no core values except for one - she truly, honestly, deep down in her soul believes that government is a force for good in the world and should be used to solve problems. Everything else is subject to negotiation or whatever the latest poll says would be popular. This means that she will not hesitate to dust off the Franklin Delano Roosevelt playbook, and try to throw money and alphabet soup government programs at the nation's problems.

Unfortunately, FDR took office in an entirely different situation in which America as a country had not run up the largest debt in the history of the universe, and individual Americans had not run up the largest collective national credit card and home equity loan debt load in history (in the 1920's and 1930's, if you wanted to buy a home, you had to have something called a "down payment"). Since there will thus be no money available for President Clinton's desired programs, the only option will be to print more - lots and lots more - which will destroy what is left of the value of the dollar, and relegate the last vestiges of America's empire to the scrap heap.

Master Yoda remarked to Obi Wan Kenobi at the end of Empire that "there is another," when all looked hopeless. He was referring, of course, to Princess Leia. Unfortunately, that was a movie, and this is real life. Of all the declared candidates for President, only one is talking about taking the necessary hard steps to restore the value of the dollar and preserve the current American standard of living - Ron Paul - and he does not currently appear to have sufficient name recognition to be able to win it all. I predict, however, that he will show surprising strength that will force the mainstream media to finally pay attention to him as the campaign wears on and the economy worsens.

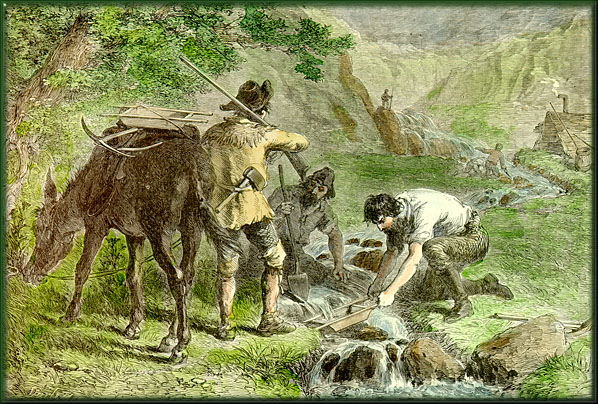

Normally, I am not an advocate of voting for fringe candidates you agree with who don't have a chance to win on the grounds that you are thereby not only wasting your vote, but actually taking a vote away from the candidate of the two major parties who you dislike least. I am going to make an exception this time because, as mentioned before, America is facing its most serious existential crisis since the Civil War and not one other candidate is addressing the seeds of our coming financial implosion at all. Paul, on the other hand, is speaking directly and clearly about what needs to be done - pull our troops back from their outposts scattered all over the world that we can no longer afford, drastically slash federal taxes, spending, and regulation, and put our currency back on a modified gold standard so it has actual value. The rest of the world is in the process of taking away our national credit cards so there are no other choices available.

Many criticize Paul for his plans to withdraw from Iraq, just as it is becoming clear that our brave soldiers are finally winning the fight against the insurgency (the main indicator that we are winning the battle on the ground is that Iraq reports are vanishing from mainstream media news outlets). The way we achieved victory was to throw more resources and troops at the problem. Unfortunately, $1.8 trillion dollars into the problem, there is no more money to expend on being the policeman for Iraq, or any other country for that matter. Once the troops draw back down to their pre-surge levels, it will be up to the Iraqis to govern themselves - and they don't have a good track record on that score. Try to guess who said the following quotes:

...We rushed into the business with our usual disregard for a comprehensive political scheme. We treated Mesop[otamia] as if it were an isolated unit, instead of which it is part of Arabia.... When people talk of our muddling through it throws me into a passion. Muddle through! why yes, so we do—wading through blood and tears that need never have been shed.

...We are largely suffering from circumstances over which we couldn't have had any control. The wild drive of discontented nationalism...and of discontented Islam...might have proved too much for us however far-seeing we had been; but that doesn't excuse us for having been blind.

No, it wasn't Barrack "Audacity of Hope" Obama (what is supposed to be so audacious about hope anyway?); it was Gertrude Bell, an administrator of the British Mandate in Iraq in the 1920's, which ended about the same way as our try at civilizing Iraq will end soon. Some things never change.

Read all about Congressman Paul's economic ideas in the best of his books. Go, Ron, GO!